Chargeback process: An in-depth look.

When a customer disputes an order and files a chargeback, the merchant has an opportunity to contest that dispute. In order to dispute a chargeback and ultimately win, a merchant needs to participate in a series of defined steps created by the card associations with the issuing and acquiring banks, who act as mediators between the customer and the merchant. (A list of players in the payments ecosystem, like acquiring and issuing banks, payment processors etc.)

As consumer protections favor the customer, merchants often find themselves in an uphill battle to win a chargeback dispute. In order to simply participate in challenging the chargeback, merchants must complete every stage of the process under increasingly tighter timeframes.

With that in mind, we’ve outlined the process, from start to finish, that any merchant will have to participate in to fight a chargeback. Our goal is to shed light on the chargeback process and help merchants understand the intricacies involved.

The Chargeback Process

After a merchant receives a chargeback notification and decides to contest it, they can initiate three dispute types or cycles:

- The first chargeback

- The second chargeback

- Arbitration

First Chargeback: The Initial Chargeback Dispute and Pre-Arbitration

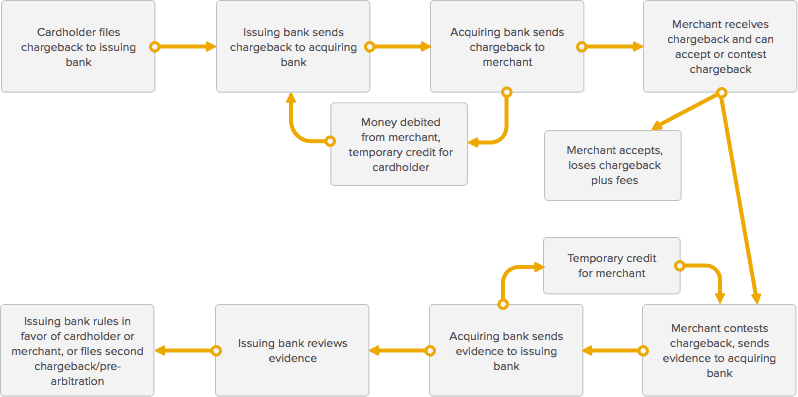

Basic flow of a chargeback

All chargeback disputes begin when a cardholder files a dispute on a transaction with their issuing bank. (On average, a cardholder has between 45-180 days to dispute a charge depending on the card association, and is sometimes able to dispute a year-old if special circumstances are considered such as natural disasters or family emergencies.) The issuing bank then reviews the claim and determines its validity, which takes anywhere from two to six weeks. Visa gives issuing banks up to 30 days to review. If valid, they then forward the claim to the merchant’s acquiring bank or payment processor, who notifies the merchant.

The merchant is simultaneously notified that they’ve received a dispute from the cardholders, and that the acquiring bank has debited funds from the merchant account to reimburse the cardholder for the transaction and to cover the fees for investigating the chargeback. (The reimbursement exists as a temporary credit for the cardholder and can be later transferred back to the merchant should they win the chargeback dispute.)

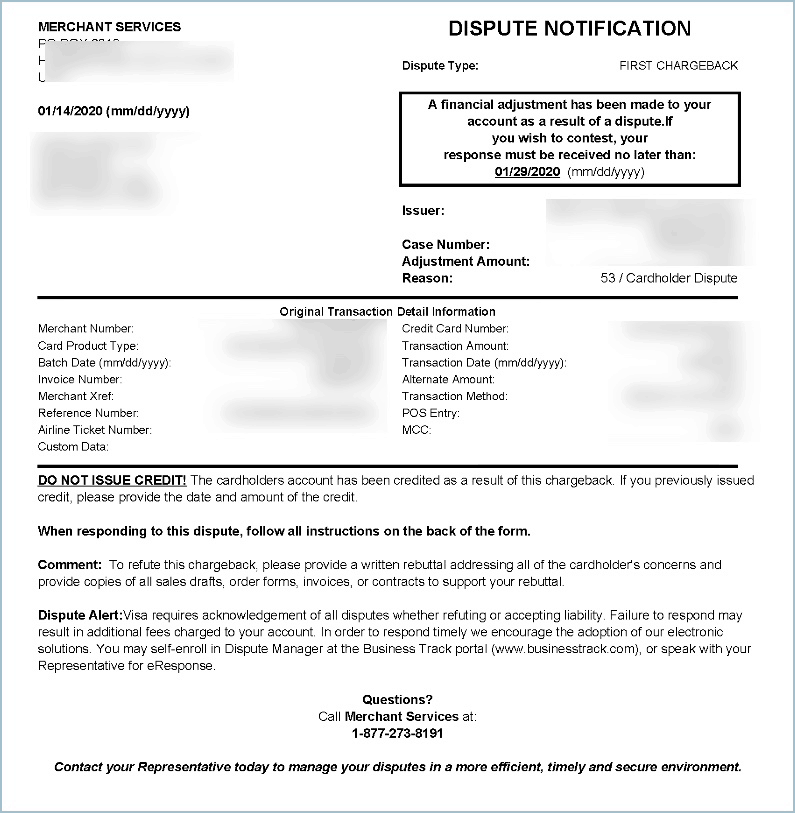

Below is an example of a standard chargeback notice that a merchant may receive. Each bank or processor may have a different format, but the details included will be the same.

Sample chargeback notice

When the acquiring bank or payment processor notifies the merchant of the chargeback dispute, with their version of the above notice, they also pass along forms to the merchant to complete and return, in order to explain their side of the dispute. (Merchants are usually given a very tight deadline in which to respond to the request, on average around 7-10 days.)

The merchant is also often asked for detailed evidence to prove that they did fulfill the order to the customer as described, including documentation like:

- Proof of shipping (usually in the form of a tracking number, shipping receipt etc.)

- Sales or transaction receipt

- Matching bill-to and ship-to addresses

- Proof of delivery (usually in the form of a delivery receipt from a shipping provider, a confirmation email etc.)

- Positive AVS response

- Any conversations with the customer, or any other evidence that the merchant fulfilled the transaction

The acquiring bank will take the forms they receive back from the merchant and pass them to the cardholder’s issuing bank. Once the acquiring bank passes the evidence to the issuing bank, the acquiring bank posts a temporary credit back in the merchant account for the chargeback amount. (At this time, two temporary credits exist — one to the cardholder and one to the merchant. When the chargeback dispute is resolved, one of these credits becomes permanent, and one reverses to a debit.)

The issuing bank then reviews the evidence submitted by the merchant to determine whether or not the merchant fulfilled the transaction as described, which takes between 4-6 weeks, with Visa limiting the issuing bank to 30 days for review of the evidence. An important note is that with Visa chargeback, merchants only have one shot (one round of pre-arbitration) to gather and submit their evidence to submit to the issuing bank before the issuing bank decides to side with the merchant or move to arbitration. One of three things will occur:

- If the issuing bank rules that the merchant has not provided compelling evidence, they’ll rule in favor of the cardholder and the chargeback stands. The provisional credit to the cardholder becomes permanent and temporary credit reversal takes place for the merchant. The acquiring bank can push for arbitration at this stage if they wish.

- If the issuing bank rules that the evidence provided by the merchant has successfully refuted the chargeback, they’ll rule in favor of the merchant and the provisional credit to the merchant will become permanent. The cardholder will see a charge for the original transaction posted again on their account.

- The issuing bank rules that the merchant successfully refuted the chargeback, but chooses to file a second chargeback of pre-arbitration, due to new information from the cardholder, or because of a change to the chargeback code.

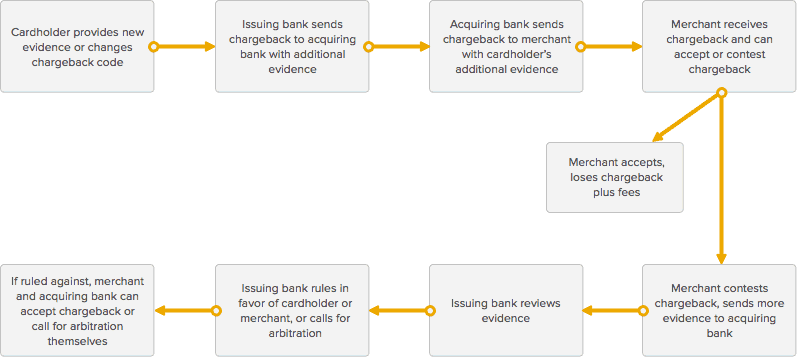

Second Chargeback (Pre-Arbitration): Fighting Another Round (Not Applicable for Visa)

Mastercard, Discover and American Express allow for a 2nd round of pre-arbitration while Visa limits pre-arbitration to one round. A second chargeback, also called pre-arbitration, occurs when, after a merchant disputes the first chargeback, the issuing bank pushes another chargeback on the same disputed transaction for any of the following reasons:

a) There is new information from the cardholder

b) There is a change to the chargeback reason

c) The documentation provided by the merchant is incomplete, invalid or was not compelling

When the issuing bank notifies the acquiring bank of the second chargeback, and that information is passed to the merchant, the merchant is again given the opportunity to accept or contest.

If a merchant decides to continue contesting the chargeback, the acquiring bank requires the merchant provide further compelling evidence from the merchant that they fulfilled the order to the issuing bank’s cardholder, in order to win the dispute.

(Usually, the merchant is asked to provide information they didn’t provide in the first chargeback cycle, like AVS response, matching bill-to and ship-to addresses, any conversations with the customer etc.)

Once the merchant provides the additional information to the acquiring bank, and it’s relayed to the issuing bank, the issuing bank will then review the evidence and determine if:

1) The merchant has provided compelling evidence.

2) The merchant has not provided compelling evidence.

If the merchant provided compelling evidence, the issuing bank will close out the chargeback, the temporary credit to the merchant for the transaction amount will become permanent and the cardholder has the transaction reposted to their account.

If the issuing bank determines that the merchant has not provided compelling evidence, the temporary credit to the cardholder for the transaction amount will become permanent and the merchant loses the chargeback amount, plus fees.

If the merchant and acquiring bank disagree with the issuing bank’s decision, or if the issuing bank requests it, either party may call for arbitration by the card association to make a final decision.

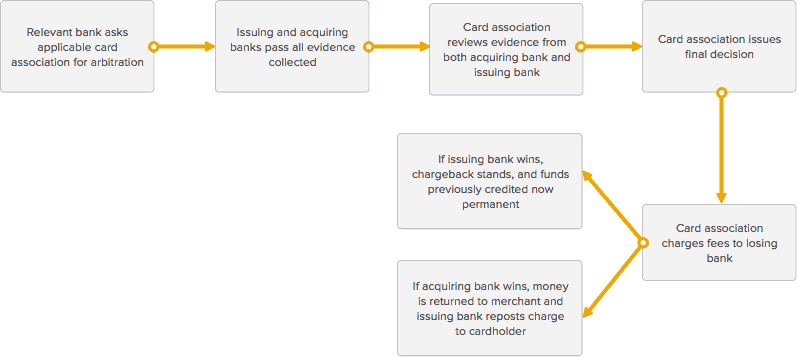

Arbitration: The Last Stand

The final step that a merchant may encounter in the chargeback process is called arbitration. Arbitration involves the relevant card association stepping in to help resolve the dispute between the acquiring and issuing banks, and by extension the merchant and the cardholder.

At this point, the acquiring bank and the merchant have an opportunity to decide whether or not they want to move forward and enter into arbitration. Acquiring banks and merchants often want to avoid entering arbitration, because of the large fees, time and effort involved. (Fees are often around $500-900 on average, and more depending on the card association, and the entire arbitration process adds, on average, around 10-45 days to the whole chargeback process.) Merchants may choose to avoid entering into arbitration for transactions below a certain amount, but find it worth the effort on transaction worth thousands of dollars.

Should the acquiring bank and merchant decide to enter into arbitration, the relevant bank (whomever initiated the call for arbitration) will reach out to the applicable card association (Visa, Mastercard, American Express, etc.) and engage in their arbitration proceedings, which are different for each card network. (All banks that are a part of a card association’s network agree to the terms and conditions of using their brand and must follow all the rules and associated fees for items like arbitration.)

The card association will review all the evidence supplied by both the issuing and acquiring banks and make a final decision on what party to rule in favor of for the chargeback dispute.

After the card association has made their decision, the chargeback dispute is closed and the losing bank must pay the arbitration fees.

1). If the card association rules in favor of the cardholder, the provisional credit posted to their account becomes permanent and the acquiring bank removes the temporary credit from the merchant’s account to refund the issuing bank. The merchant is also on the hook for the hefty fees from the card association.

2). If the card association rules in favor of the merchant, the provisional credit posted to the merchant account becomes permanent, and the transaction is reposted to the cardholder’s account by the issuing bank. The issuing bank is responsible for the fees associated with arbitration. (Note: The situation where a card association rules in favor of a merchant during arbitration is incredibly rare.)