Thrifty Direct Deposit Payment Solutions

Get Your Direct Deposits Processed within Seconds

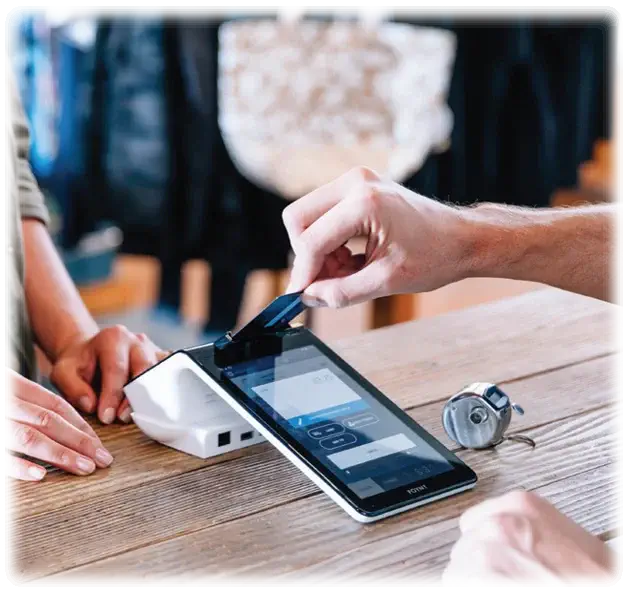

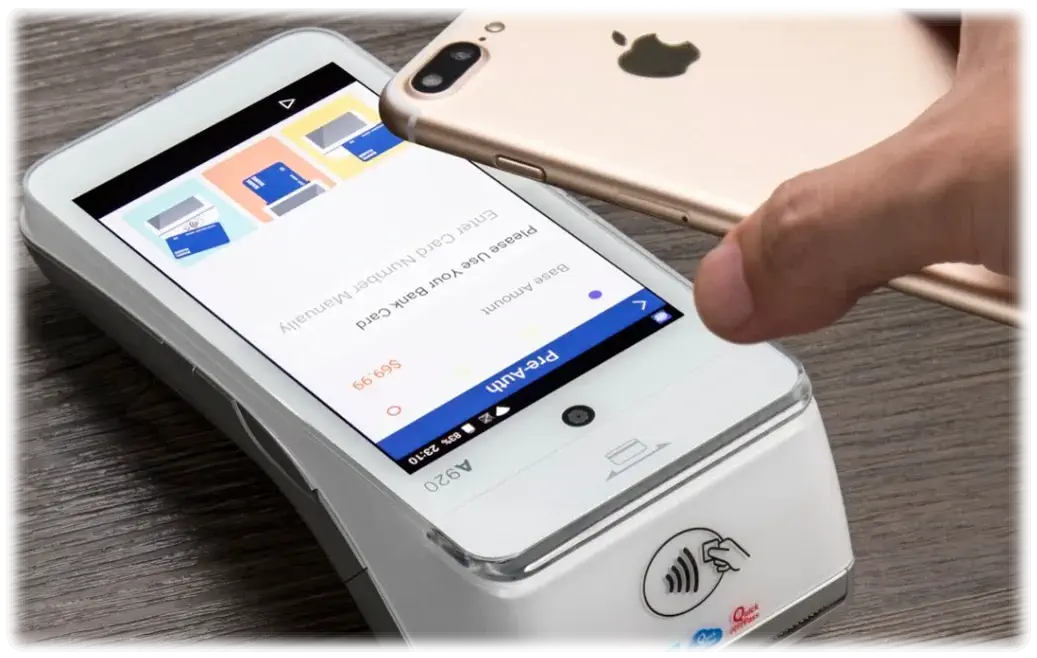

The age of papers is gone. Electronic payments have taken the world by storm. Direct deposit means the transfer of money electronically without the intervention of any physical or financial elements. There is no need for waiting in queues because everything is done electronically. Whether it is paychecks, tax refunds, or other benefits, Thrifty Payments is your premium partner in processing direct deposit payments.

No Queues

You must have stood in a long queue at least once. It is frustrating and time-consuming. With direct deposits, you say goodbye to all types of queues.

Lightning Quick

The process of direct deposits is lightning-quick. Funds are transferred within the blink of an eye.

Electronic Network

An electronic network between different financial institutions facilitates direct deposit payments.

Safe and Secure

Direct deposit procedures are very safe and secure from start to finish.