Your Reliable Partner for Credit Card Payment Terminals

Offering hassle-free and secure payment solutions has become more crucial than ever. Whether you're a small or large business, finding effective credit card payment terminals is essential to satisfying your customers, facilitating smooth sales, and guaranteeing safe transactions. With Thrifty Payments, you can find a wide range of credit card terminals that cater specifically to your business requirements, from conventional credit card terminals to advanced virtual credit card terminals and wireless solutions.

The Significance of Selecting the Appropriate Credit Card Payment Terminal

A credit card payment terminal is a vital device that enables merchants to process card payments securely and efficiently. The terminals not only enable seamless credit card processing but also improve customer experience by offering instant and secure payment at the point of sale (POS). Your selection of a credit card terminal machine can have a significant impact on your business's sales process and working efficiency.

For small businesses, selecting the best credit card terminal is crucial. Small business credit card terminals, such as the Clover Mini 3rd Generation or the Poynt C POS terminal, are built with portability, simplicity of use, and the capability to handle various payment methods, including EMV chip cards, contactless payments, and mobile wallets.

Types of Credit Card Terminals Provided by Thrifty Payments

At Thrifty Payments, we recognize that each business is different. That's why we provide a range of credit card terminals such as:

Credit Card Point of Sale (POS) Terminals: These are traditional credit card POS terminals used in retail, hospitality, and service industries. They accommodate credit card point-of-sale terminal transactions for easy payment and accurate sales tracking.

Wireless Credit Card Terminals: For companies that require mobility, our wireless credit card terminal solutions, such as the Newland N910 POS terminal machine, allow merchants to accept payments on the move, whether at a trade show, outdoor event, or a remote site.

Mobile Credit Card Terminals: The PAX A920 and E500 Credit card terminals are portable, handheld devices that connect through cellular or Wi-Fi networks, making mobile credit card processing easy and effective.

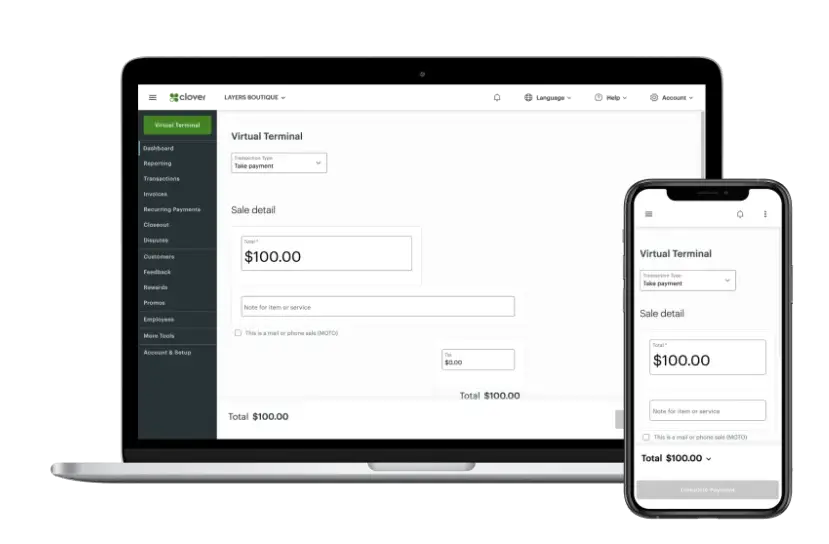

Virtual Credit Card Terminals: Our virtual terminal credit card processing products, including the virtual credit card terminal and the credit card virtual terminal, enable merchants to accept online or phone payments, providing convenience and security for online credit card transactions.