Virtual Terminals Vs. Payment Gateways: How They Compare And How To Implement Them?

Calling out, business owner and payments nerd! Today, we're going to discuss a subject that can make or break your online payment experience — the best virtual terminals and payment gateways. Whether you're a startup, an emerging business, or a mature business, you need to be familiar with these tools to establish a seamless payment environment. So, please fasten your seat belts as we examine the top virtual terminals, their most widely used advantages, and how virtual terminal solutions can transform your entire payment infrastructure.

What Are Payment Gateways And Virtual Terminals?

In essence, virtual terminals in the USA and globally are computer applications that enable you to accept and process customer transactions without the bother of bulky traditional point-of-sale hardware. Imagine them as your web-based credit card terminal — a secure web gateway that enables you to take credit card payments directly over the internet from any web-enabled device.

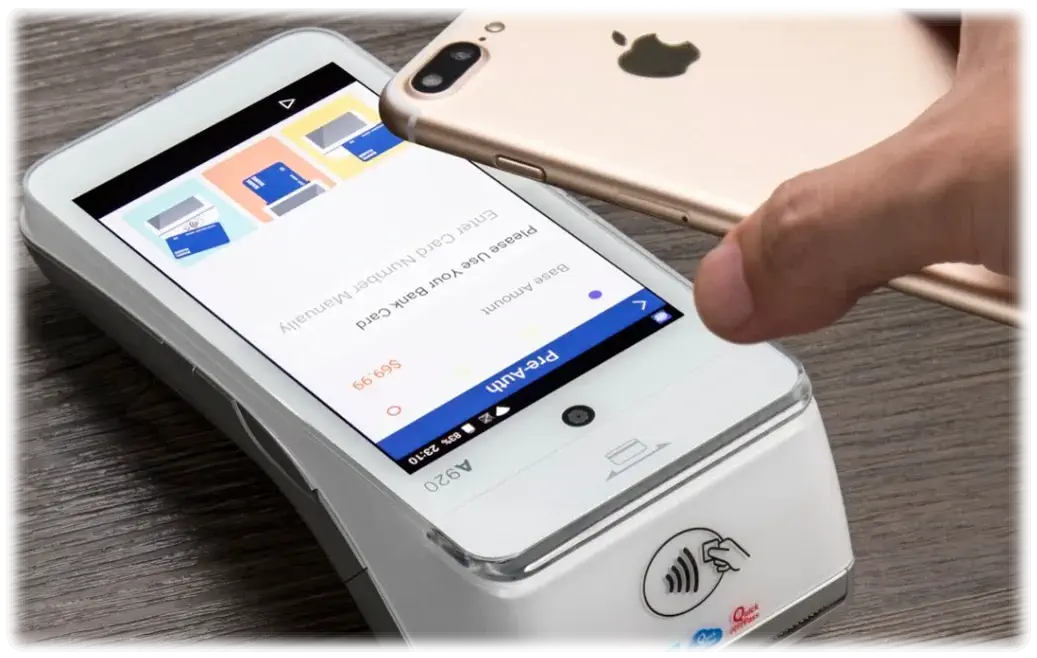

At the same time, payment gateways are the online bridges that connect your web terminals to your payment processors. They securely process and authorize the payment information, ensuring that your customer's card security code and details are handled with utmost care.

How Are Virtual Terminals And Payment Gateways Different?

Virtual Terminals

Functionality: They let you take card payments directly through a virtual credit card terminal on your computer or app.

Usage: They are used by businesses to accept online payments by connecting to an online terminal or a bespoke app.

Scope: Primarily online processing and credit card payment acceptance.

Implementation: Requires the installation of the virtual terminal, which typically supports platforms such as Linux or Square Virtual Terminal.

Payment Gateways

Functionality: They serve as the intermediary between your virtual terminals and payment processors, processing and submitting payment information.

Utilization: Embedded into your payment system, they connect payment terminals with merchant accounts.

Scope: Integrate security features, manage chargebacks, and process fees.

Implementation: Integration into your financial processes and virtual terminal services.

In brief:

Virtual terminals are the places or programs by which you receive payments online, while payment gateways are the platforms by which your payment details are securely passed on to carry out the transactions.

Essentially, computer network virtual terminals serve as the interface for enabling customer transactions, while payment gateways act as middleware, facilitating secure and seamless payment processing for terminals.

How To Install Virtual Terminals And Payment Gateways

It can seem daunting to begin with virtual terminal services and virtual terminal payment processing, but the correct strategy makes it a breeze. Here is a step-by-step approach:

Review Your Overall Payment Infrastructure: Before selecting the best virtual terminals for your purpose, review your overall payment infrastructure. Reflect on the workflows and financial processes you need to automate.

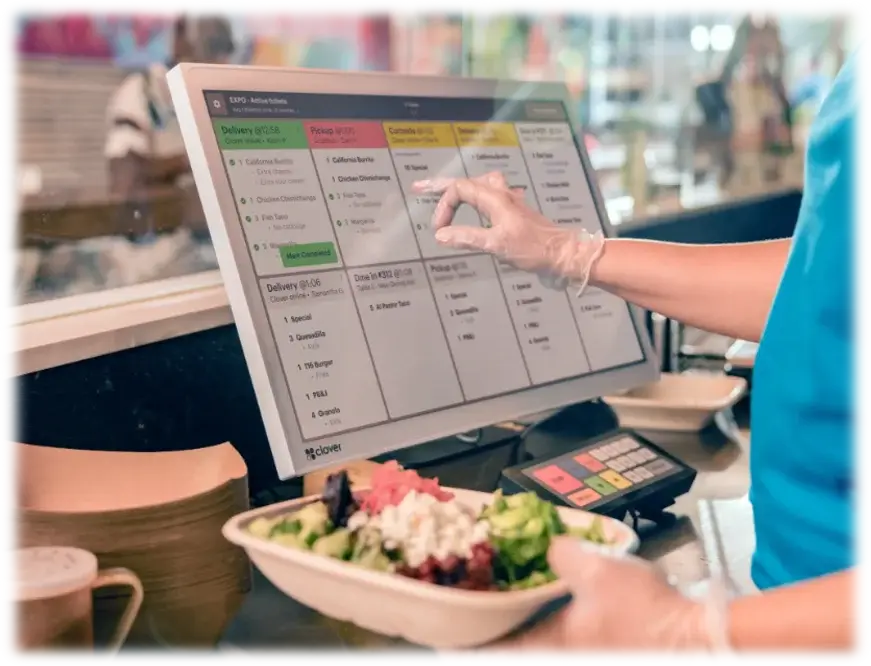

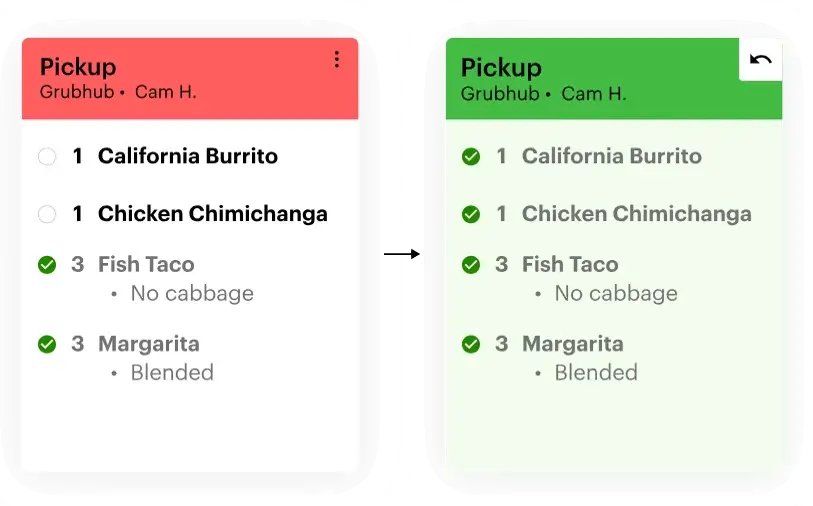

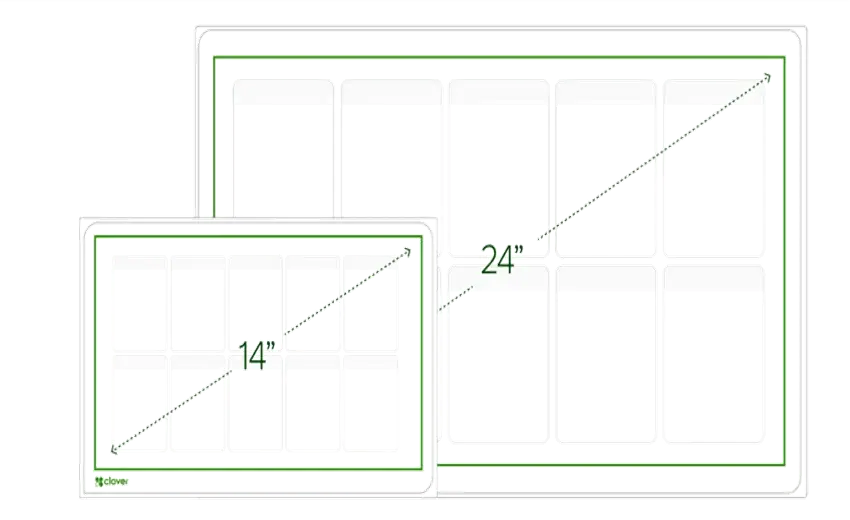

Choose the Right Virtual Terminal: Choose virtual terminal products that suit your business size and needs. For example, Square Virtual Terminal is renowned for its seamless virtual terminal app, whereas Clover's Credit Card Terminals are suitable for both physical and virtual integration.

Verify Compatibility: Ensure your chosen virtual terminal credit card processing software is compatible with your existing point-of-sale equipment or virtual terminals, as well as with Linux if you are working on open-source platforms.

Secure Processing Online: Ensure the computer network virtual terminal protocol has robust security—verify PCI certification and support for card security code encryption.

Install Virtual Terminals: Login & Access. Install the user account for your employees and train them in virtual terminal login, with an emphasis on accepting payments on any internet-connected device.

Integrate with POS Software Providers & Payment Processors: Select payment processors and POS software providers that offer transparent processing fees for virtual terminal services and have high reviews for their virtual terminals.

Test the System: Perform virtual terminal payment processing testing using virtual terminal sample scenarios and ensure virtual terminal credit card data is transacted securely.

Go Live: Once tested, initiate processing customer transactions and monitor your workflows, chargebacks, and financial activity to ensure smooth operation.

The Most Popular Advantages Of Virtual Terminals

Why are virtual terminals becoming the first choice? Here are the most popular trending advantages of virtual terminals:

Flexibility and Accessibility: With a computer network, you can accept credit card payments online from anywhere with an internet connection, making virtual terminals a convenient option for on-the-go transactions.

Cost-Saving: No money needed for expensive point-of-sale hardware! And most virtual terminal vendors offer competitive processing rates.

Improved Security: Your credit card transactions online via your terminal are safeguarded against data theft and fraud through the current virtual terminal protocol in computer networks.

Simplified Workflows: They streamline workflows and accounting processes by integrating with financial, accounting, and CRM software.

Ease of Use: The software for virtual terminals is user-friendly, allowing employees to process card payments without encountering any technical issues.

Best for Remote Sales: Ideal for virtual terminals in the United States, suitable for remote or e-commerce use.

Fewer Errors: Electronic virtual terminal credit card data entry reduces human errors.

Enhanced Chargeback Management: Efficiently manage chargebacks with accurate transaction records.

Compliance & Security: Stay PCI compliant, with card security code encryption and secure virtual terminal online transactions.

How Virtual Terminal Services Are Adapting To B2B Payment Complexity

The payment environment is changing rapidly, particularly in the B2B sector. The evolution of virtual terminal services is the buzz: Multi-user access and permissions. Virtual terminal software today offers extremely fine-grained login restrictions for virtual terminals, enabling teams to process consumer transactions safely.

Subscription & Recurring Billing: Most virtual terminal solutions offer recurring payments, a requirement for B2B subscriptions.

Multiple Payment Options: Whether it's credit cards, ACH virtual terminals, or other methods, businesses can accept payments on any internet-connected device, diversifying their revenue streams.

ERP & CRM Integration: Seamless integration with business processes and financial operations makes virtual terminals a necessity.

Improved Security Features: With increasingly common cyberattacks, virtual terminal protocols support enhanced encryption and authentication to protect against these threats.

Global Coverage: Virtual terminals across the US and worldwide offer multi-currency support, enabling comprehensive payment setup for global B2B commerce.

Why Thrifty Payments Is different

In handling virtual terminal services, you've landed on the right site with ThriftyPayments. They offer some of the top trending benefits of virtual terminals, including transparent processing fees and excellent reviews of their virtual terminal. Their virtual terminal product offers secure online processing, integrates easily with your existing payment infrastructure, and provides a virtual terminal program that is easy to operate on Linux or within virtual terminal environments within computing networks.

Frequently Asked Questions

Q: What is a virtual terminal?

A: A virtual terminal is an online, secure processing software that allows merchants to accept customer transactions using a virtual credit card terminal with no hardware requirements.

Q: How much does a virtual terminal cost?

A: Processing fees vary with providers but typically range from 2.9% + an additional fixed amount per transaction. Always compare virtual terminal reviews and determine which virtual terminals are best for you.

Q: What is an ACH virtual terminal?

A: It allows businesses to accept ACH payments (bank transfers) through a virtual terminal, offering a less expensive alternative to card payments.

Q: What is a virtual terminal vs a physical terminal?

A: A virtual terminal is an online-based system, while a physical terminal refers to physical point-of-sale equipment.

Q: What are the top trending benefits of a virtual terminal?

A: Virtual terminals offer several benefits, including flexibility, cost efficiency, enhanced security, streamlined workflows, and remote access.

Ready to take payments from any device that's online? Find virtual terminal solutions today and take your whole payments infrastructure to the next level! For best-of-breed virtual terminals, bespoke virtual terminal solutions, and support from experts, trust Thrifty Payments to get you up and running.

Conclusion: The Complete Payments Setup

Selecting a virtual terminal or payment gateway is not a one-size-fits-all scenario. It's a matter of overall payment setup—what's ideal for your business model, security needs, and growth strategy. The best virtual terminals are those that seamlessly integrate into your processes and financial workflow, while also accommodating secure online processing and excellent virtual terminal credit card processing